Project Finance for Business Development: A Comprehensive Guide for Business Leaders

Project finance is a specialized form of financing that is used to fund large-scale infrastructure and industrial projects. It is a complex and challenging process, but it can be a valuable tool for businesses that are looking to develop new projects.

4.4 out of 5

| Language | : | English |

| File size | : | 9134 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 401 pages |

| Lending | : | Enabled |

Project finance is typically used to fund projects that are too large or complex for traditional bank lending. These projects often involve a high degree of risk, and they may require a long period of time to complete. As a result, project finance typically involves a consortium of lenders, each of which provides a portion of the financing.

Benefits of Project Finance

There are several benefits to using project finance to fund business development projects. These benefits include:

- Access to capital: Project finance can provide businesses with access to large amounts of capital that may not be available from traditional bank lending.

- Risk sharing: Project finance spreads the risk of a project across a number of lenders. This can make it more attractive for businesses to undertake risky projects.

- Long-term financing: Project finance can provide businesses with long-term financing that is not available from traditional bank lending. This can be important for projects that require a long period of time to complete.

- Flexibility: Project finance can be tailored to meet the specific needs of a project. This can be important for projects that are complex or that involve a high degree of risk.

Risks of Project Finance

There are also some risks associated with using project finance to fund business development projects. These risks include:

- Complexity: Project finance is a complex process that can be difficult to understand and manage. This can make it difficult for businesses to secure project financing and to manage the project once it is underway.

- Risk: Project finance projects often involve a high degree of risk. This can make it difficult for businesses to obtain project financing and to manage the project once it is underway.

- Cost: Project finance can be expensive. The fees associated with project finance can be significant, and the interest rates on project finance loans can be higher than the interest rates on traditional bank loans.

Challenges of Project Finance

There are a number of challenges that businesses may face when using project finance to fund business development projects. These challenges include:

- Finding the right lenders: It can be difficult to find lenders who are willing to provide project financing. This is especially true for projects that are complex or that involve a high degree of risk.

- Negotiating the loan agreement: The loan agreement for a project finance loan can be complex and difficult to negotiate. This can make it difficult for businesses to secure project financing on favorable terms.

- Managing the project: Project finance projects can be complex and difficult to manage. This can make it difficult for businesses to complete the project on time and within budget.

Key Players in Project Finance

There are a number of key players involved in project finance. These players include:

- Sponsors: The sponsors of a project finance project are the businesses that are developing the project. The sponsors are responsible for providing the equity financing for the project and for managing the project.

- Lenders: The lenders in a project finance project are the financial institutions that provide the debt financing for the project. The lenders are responsible for assessing the risk of the project and for providing the financing on terms that are acceptable to the sponsors.

- Financial advisors: The financial advisors in a project finance project provide advice to the sponsors and lenders on the financial aspects of the project. The financial advisors help the sponsors to structure the project and to negotiate the loan agreement with the lenders.

- Legal advisors: The legal advisors in a project finance project provide advice to the sponsors and lenders on the legal aspects of the project. The legal advisors help the sponsors to draft the loan agreement and to ensure that the project is in compliance with all applicable laws and regulations.

Steps Involved in Securing Project Financing

The process of securing project financing is complex and can take a long time. The following steps are involved in securing project financing:

- Feasibility study: The first step in securing project financing is to conduct a feasibility study to assess the viability of the project. The feasibility study should include an analysis of the market, the competition, and the financial risks associated with the project.

- Project plan: Once the feasibility study is complete, the sponsors need to develop a project plan. The project plan should include a detailed description of the project, the project schedule, and the project budget.

- Financial model: The sponsors need to develop a financial model to project the financial performance of the project. The financial model should include assumptions about the project's revenue, expenses, and cash flow.

- Due diligence: The lenders will conduct due diligence on the project before they approve the loan. The due diligence process will involve reviewing the project plan, the financial model, and the legal documents related to the project.

- Loan agreement: Once the due diligence process is complete, the sponsors and the lenders will negotiate the loan agreement. The loan agreement will set forth the terms of the loan, including the interest rate, the repayment schedule, and the security for the loan.

Project finance can be a valuable tool for businesses that are looking to develop new projects. However, it is important to be aware of the benefits, risks, and challenges associated with project finance before using it to fund a project.

By understanding the key players involved in project finance and the steps involved in securing project financing, businesses can increase their chances of success when using project finance to fund business development projects.

4.4 out of 5

| Language | : | English |

| File size | : | 9134 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 401 pages |

| Lending | : | Enabled |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Chapter

Chapter Text

Text Story

Story Reader

Reader Library

Library Paperback

Paperback E-book

E-book Newspaper

Newspaper Paragraph

Paragraph Bookmark

Bookmark Bibliography

Bibliography Synopsis

Synopsis Scroll

Scroll Codex

Codex Bestseller

Bestseller Classics

Classics Library card

Library card Narrative

Narrative Biography

Biography Autobiography

Autobiography Encyclopedia

Encyclopedia Thesaurus

Thesaurus Character

Character Resolution

Resolution Librarian

Librarian Catalog

Catalog Borrowing

Borrowing Stacks

Stacks Periodicals

Periodicals Scholarly

Scholarly Reserve

Reserve Academic

Academic Journals

Journals Special Collections

Special Collections Interlibrary

Interlibrary Study Group

Study Group Thesis

Thesis Dissertation

Dissertation Awards

Awards Book Club

Book Club Nick Pease

Nick Pease Alexander S Rosenthal

Alexander S Rosenthal Chris Malone

Chris Malone Margaret George

Margaret George Steve Platt

Steve Platt Jennifer Lambert

Jennifer Lambert Katrina Cope

Katrina Cope Angelo Sommer

Angelo Sommer Rachel Scheer

Rachel Scheer Michael T Fournier

Michael T Fournier Andrew Rowen

Andrew Rowen Alexander V Pyl Cyn

Alexander V Pyl Cyn Paul Barry

Paul Barry Eric C Smith

Eric C Smith Capitol Reader

Capitol Reader Bryan Fanning

Bryan Fanning Becci Murray

Becci Murray Dan Coates

Dan Coates Mark Lardas

Mark Lardas Joe Ambrose

Joe Ambrose

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Shawn ReedFollow ·6.2k

Shawn ReedFollow ·6.2k Deacon BellFollow ·12.9k

Deacon BellFollow ·12.9k Bill GrantFollow ·6.7k

Bill GrantFollow ·6.7k John GreenFollow ·10.5k

John GreenFollow ·10.5k Thomas PowellFollow ·5.3k

Thomas PowellFollow ·5.3k Billy FosterFollow ·4.2k

Billy FosterFollow ·4.2k Jeff FosterFollow ·17.4k

Jeff FosterFollow ·17.4k José MartíFollow ·14.7k

José MartíFollow ·14.7k

Dylan Hayes

Dylan HayesUnscientific America: 11. Harris and Chomsky

In this chapter...

Kenneth Parker

Kenneth ParkerThe Ultimate Flight Attendant Essential Guide: A...

If you're passionate about travel, meeting...

Bill Grant

Bill GrantFrom Armed Struggle to Political Struggle: The Evolution...

Liberation movements have...

Brady Mitchell

Brady MitchellSquirreled Away: Boy Meets Squirrels, Nutty Study...

In the heart of a sprawling...

Pete Blair

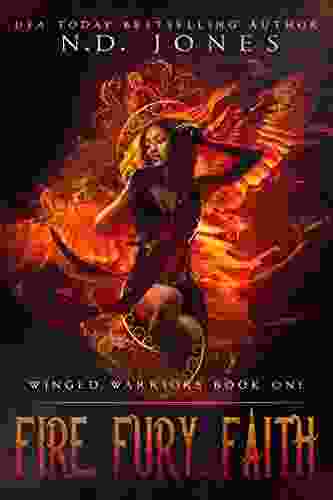

Pete BlairFire Fury Faith: An Angel Romance with Winged Warriors

Synopsis Fire Fury...

4.4 out of 5

| Language | : | English |

| File size | : | 9134 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 401 pages |

| Lending | : | Enabled |